If there is one thing that makes me cringe harder than hearing about “blockchain startups”, it is people who claim to be “cryptocurrency analysts”.

2018 might have started off with a bang for crypto traders, but this ecstasy wasn’t long-lasting as all the joy was sucked out of the markets after the first couple of weeks. Almost through the entire year, the markets have seen red. Consider this: the global cryptocurrency market capitalization was in excess of $830 Billion in early January, but as of today, the 20th of November, it stands at $154 Billion, down by over 81% when compared to the all-time high.

While the entire year has been such, the past week has been even brutal because close to 25% of the existing market cap was wiped out in a span of four days. The overall market cap fell from $210 Billion to $154 Billion – while a drop of $50 Billion may not seem much after markets fell from $830 Bn to $154 Bn, but it is a significant collapse when one takes into account the percentage of the market cap that has disappeared.

The recent crypto market crash has proven one thing: practically anyone who calls himself/herself an ‘analyst’ is lying to you on your face. As someone who has been writing every day about cryptocurrencies for over a year now, my biggest takeaway has been that: Ten years since the Bitcoin whitepaper was published, no one still understands what drives the markets.

If you Google for ‘Cryptocurrency Name’ + ‘Price Analysis’, you are likely to find hundreds thousands of links which tell you about how the markets are moving. These web pages will tell you about a ‘support level’ or a ‘resistance’ between which the price of your currency is likely to play. Sometimes they will tell you that a ‘Triangle is forming’ which can either mean your currency will boom or bust depending on the fertile imagination of the writer. If these don’t intrigue you enough, they’ll even come up with names such as ‘the arch of doom’, which sounds more like a wrestler’s finishing move than something you’d see on a graph, but well. Sometimes, the animal kingdom gets involved as well. Everyone wants to throw in bulls and bears, sometimes even when it doesn’t make any sense.

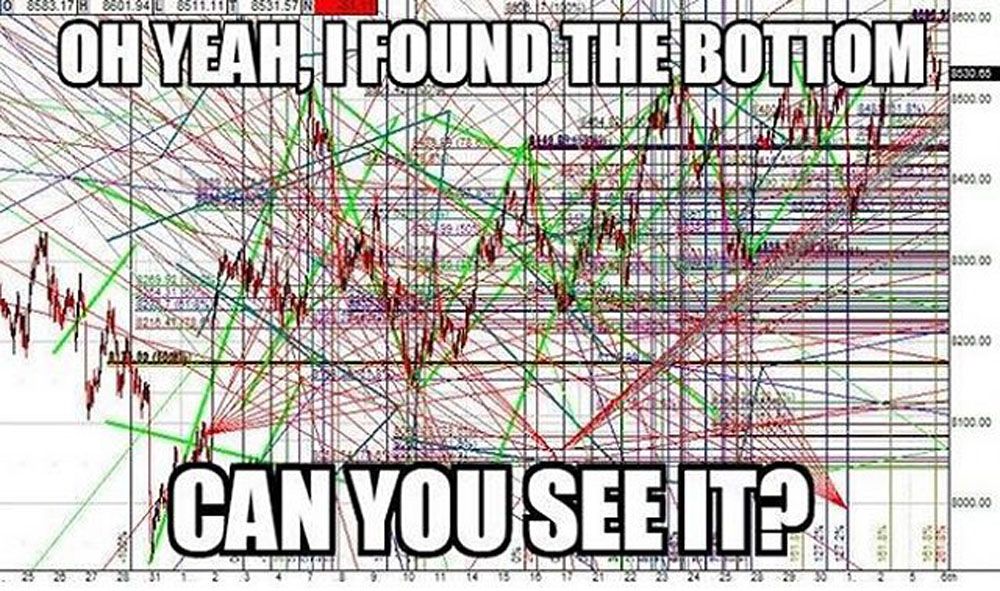

Some of them even like to put up graphs. Red lines, green lines – understandable. Then there are black, blue, pink, green and brown lines, added by a dotted orange line and a dashed purple line, followed by small round cirlces and big triangles? It leaves me wondering, what are they even trying to prove here.

And then they’ll come to adding reasons to their logic. “this movement in the markets is happening because the blockchain platform tied up with China’s President’s Aunt’s Grandson’s Pet Dragon’s startup”. Sometimes, it’s worse, for example, the most common reason attributed to the fall of Bitcoin prices late last year was attributed to Christmas. Why? because “people are cashing out their Bitcoins to buy Christmas gifts”. By this logic, 2018 has been a year where every day has been Christmas.

While this old-school method of analysis works out for the stock market from time to time, there is no conclusive evidence that it has any logic when it comes to the world of cryptocurrencies. Can we please stop believing in this hogwash and stop writing these technical analysis articles which are nothing but a garbled mixture of jargons which even a bot could write with the same accuracy as a human being?

This problem is likely to last till the time we understand cryptocurrencies were never meant to be an asset for investment – and try and incorporate them for the purpose they were actually built for, as a token of exchange.